8+ Irs Installment Agreement While In Chapter 13

This is the deadline to collect. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Irs Issues Chapter 7 Pp National Income Tax Workbook Ppt Download

Check Now If You Qualify.

. Our experts can help guide you through our process and gain financial stability again. But they are only required to pay on the general unsecured portion. Youd not have to pay anything.

Now that the April 15 th tax filing deadline has passed many tax debtors are facing the dilemma of how best to pay past due tax liabilities and are weighing the advantages of a chapter 13. Stop IRS Collections and your IRS Wage Garnishment. How Is an Existing IRS Installment Plan Treated in Chapter 13.

Ad Payment Plan Tax Settlement Experts Get Your Qualifications Options Free. Therefore if you have significant penalties on. Call or Request Online.

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Our experts can help guide you through our process and gain financial stability again. You do not have to wait for the discharge but bear in mind that interest will continue.

All pre-petition penalties and post-petition interest are discharged in Chapter 13 if the debtor completes the Chapter 13 plan. PPIAs usually last until the end of the 10-year collection statute. Ad Make Monthly Installments With An IRS Gov Installment Agreement.

These Standards are effective on April 25 2022 for purposes of federal tax administration only. An IRS Installment Agreement is of particular benefit to those who have filed for chapter 7 bankruptcy in Colorado Bankruptcy Court. In a chapter 13 bankruptcy the law allows a few things that can make the situation easier and more realistic than a payment plan based on the IRS budget.

Ad You Dont Have to Face the IRS Alone. Ad 100 Free Tax Evaluation. Expense information for use in bankruptcy calculations can be found on the website for the.

When Chapter 7 Makes Sense. Chapter 13 filers are required to pay the secured and priority portions of their IRS claims in full over a 5 year period. While a chapter 13 bankruptcy allows for the.

Also the IRS can not ask or demand payment while the automatic stay is in place. If this is debt that was incurred prior to filing the Chapter 13 case then the Trustee is not likely to agree to a separate payment plan for the debt this is debt that should be paid as. Stop IRS Collections and your IRS Wage Garnishment.

Get the Help You Need from Top Tax Relief Companies. Apply For Tax Forgiveness and get help through the process. A partial payment installment agreement PPIA is a long-term payment option.

If ALL the income tax debt in your present monthly payment plan is dischargeable Chapter 7 likely makes sense. Free Case Analysis to Get ALL Qualification Options. If you are currently paying your tax debts through an IRS installment plan you will not be allowed to continue with.

Ad 100 Free Tax Evaluation.

Struggling In Irs Payment Plan Chapter 13 Bankruptcy May Be The Solution Anderson Law Pc

Irs Installment Agreements Denver Tax Debt Lawyer David M Serafin

If I File Bankruptcy Do I Still Have To Pay An Irs Installment Agreement Youtube

Irs Payment Agreement And Chapter 13 Legal Answers Avvo

3 12 38 Bmf General Instructions Internal Revenue Service

Can I Include Irs Debt In My Chapter 13 Case Bond Botes Law Offices

Can A Chapter 13 Bankruptcy Help You Pay Back Taxes Steiner Law Group Llc

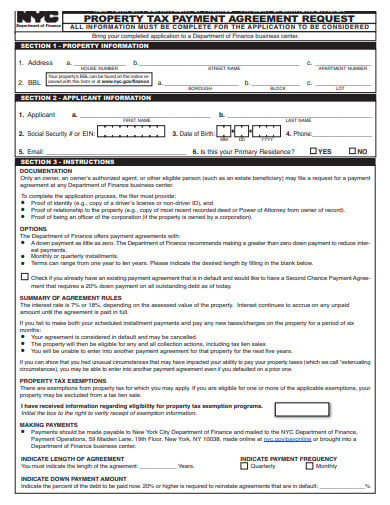

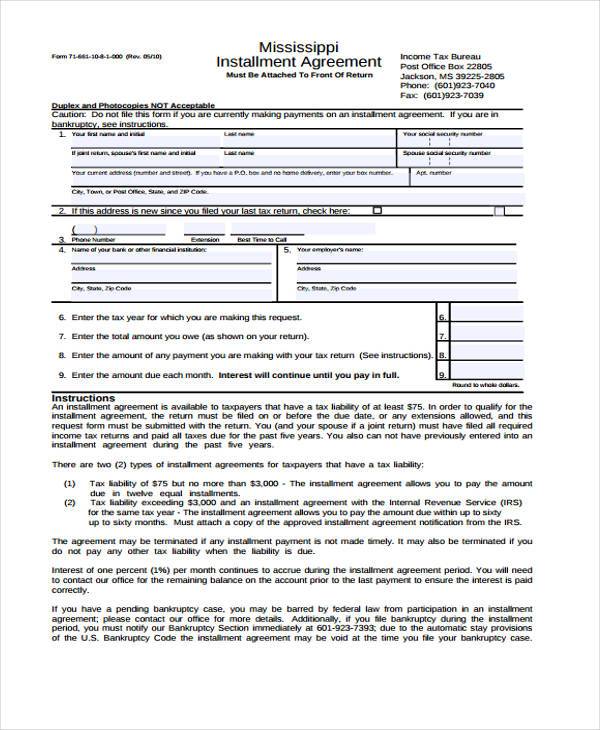

21 Payment Agreement Templates In Google Docs Pages Ms Word Pdf Free Premium Templates

Document

50 Years Of The Berlin Tv Tower Tv Turm

Free 8 Installment Agreement Form Samples In Pdf Ms Word

How Does Chapter 13 Bankruptcy Affect Tax Debt Steinberger Law

3 13 5 Individual Master File Imf Account Numbers Internal Revenue Service

3 17 79 Accounting Refund Transactions Internal Revenue Service

50 Years Of The Berlin Tv Tower Tv Turm

Irs Payment Agreement And Chapter 13 Legal Answers Avvo

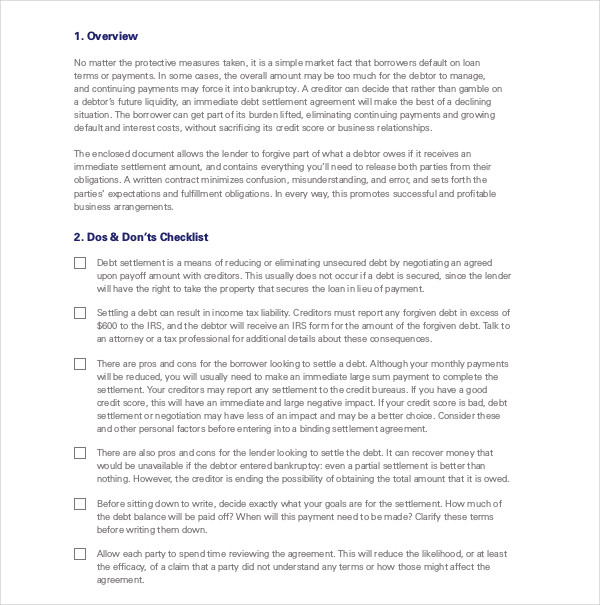

Debt Agreement Contract 8 Examples Format Pdf Examples